Setting Up a Budget

A budget, also called a spending plan, can help you prioritize expenses, save for your future and stay out of debt, all of which contribute to a happy and healthy life.

- The first step to creating a realistic spending plan is tracking your spending. For one month, write down everything you spend, even small purchases like a soda or pack of gum. At the end of the month, do the math and look for specific spending habits like how much you spend on entertainment, fuel or extracurricular activities. These habits form your budget categories; everything you spend money on should have a category.

- Next, identify your income. Include paychecks, tips and even gift or birthday money. It’s important to have a clear picture of what you're working with so you can create a realistic plan.

If your income varies, consider budgeting based on your average paycheck or the least amount you know you’ll bring home. Treat anything above that amount as a bonus that can help you reach your goals. - Then, plan for your expenses. Expenses are either fixed or variable. Fixed expenses are always the same, like your car or insurance payments. Variable expenses are a little harder to plan for because the amount changes, like fuel, entertainment or extracurricular activities. That’s why tracking your expenses is so important; it’s how you determine an accurate estimate of what you actually spend over time.

Also, plan for expenses that don’t happen every month. Take the amount due and divide it by the number of months you have to save. Planning ahead means you won’t be surprised when the bill is due.

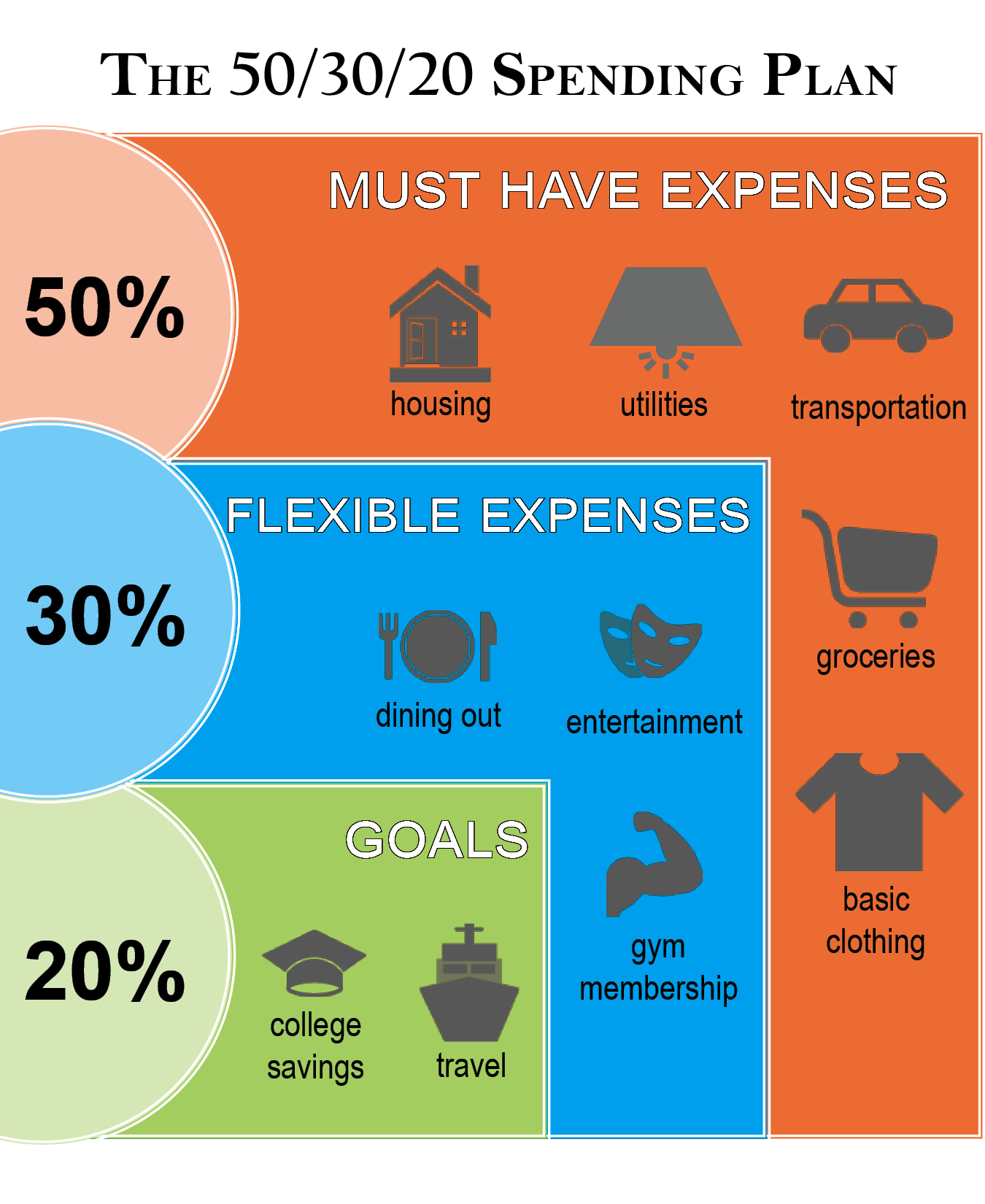

One common method to break down a budget is the 50/30/20 spending plan. As shown in the image below, you would allocate 50% of your income to essential expenses, such as housing, transportation and groceries; 30% to flexible expenses, like dining out and entertainment; and 20% to savings to cover unexpected costs, build an emergency fund, and meet personal or family goals, such as college planning, travel, and retirement.

::Ways to Budget::

Luckily there are many ways to budget, so if the first method you try isn’t right for you, try something else.

If you prefer to use cash, the envelope system may work well for you. After you identify your spending habits and create your spending categories, label a plain white envelope for each category. Put your budgeted money in the corresponding envelopes and spend from there. Remember to protect your money, keep your envelopes in a safe place and always know who has access to them.

If you bank online, you may have access to online budgeting tools. Online banking allows you to manage your account 24/7, noting which purchases have cleared your account and which are still pending. Visit with someone at your bank, or go online to learn about your bank’s options.

Online tools, websites and apps are also good options. Here are some free options to explore.

If you realize you’re spending too much money, do what you can to cut back. If you’ve slashed expenses and still don’t have enough money, increase your income by finding a better paying job, turning a hobby into a job or do odd jobs like baby-sitting or mowing lawns. Sometimes all you need is some marketing and a little creativity to make some extra cash.