Budgeting

Financial success hinges on creating and sticking to a budget. A budget, also called a spending plan, allows you to plan your monthly expenses and track where your money goes. Budgeting isn’t always easy, but keep trying! You may fail a few times, but if you stick with it you’ll find a method that works for you. To begin on a positive note, check out these budgeting success tips.

::Where do I begin?::

Use our free online personal budgeting tool or create your own using a spreadsheet or online software. To complete a customized spending plan, you’ll need to:

- Know your monthly income. Income can come from a paycheck, child or spousal support or unexpected cash in the form of gifts, tax returns or rebates. If your monthly income varies because your work hours change or you earn commission, build your budget using your base salary or the average of your last few months’ worth of paychecks.

- List your financial responsibilities. Tally the bills and expenses you pay each pay period and how much they typically cost. Don’t forget to include irregular expenses, like insurance premiums or property taxes. Fixed expenses are easier to track because they stay the same each month—like mortgage, car or student loan payments. Variable expenses, like groceries, fuel and entertainment, are trickier because they change from month to month. Include saving as a financial responsibility; pay yourself first before paying bills.

- Track your spending. Monitor your variable expenses to make planning easier. Keep your receipts and write down all transactions for one month so you can get an accurate picture of your spending habits.

- Categorize your spending. Next, pull out your receipts and list of financial transactions and lump them together in like categories. You’ll probably see groups form for “dining out,” “entertainment,” “clothing,” “household maintenance,” “groceries,” etc. Based on your current spending, create spending categories and assign each a monthly spending amount.

- Do the math. Subtract predicted expenses from your projected income. If you’re already over budget, refine some of your variable expense categories and try again. After implementing your budget for a month, adjust your categories-or spending-accordingly to better meet your needs.

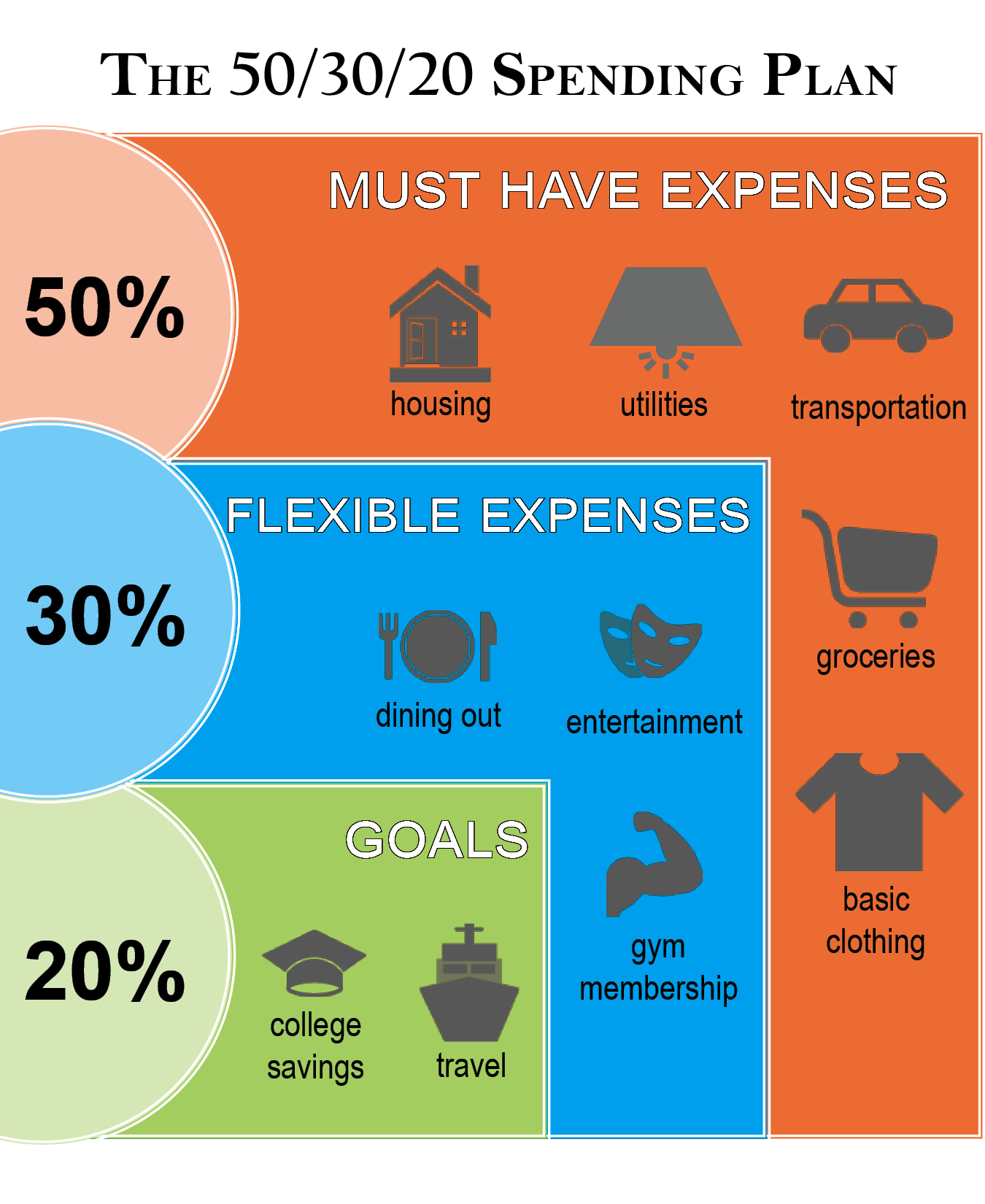

One common method to break down a budget is the 50/30/20 spending plan. As shown in the image below, you would allocate 50% of your income to essential expenses, such as housing, transportation and groceries; 30% to flexible expenses, like dining out and entertainment; and 20% to savings to cover unexpected costs, build an emergency fund, and meet personal or family goals, such as college planning, travel, and retirement.

If using a spreadsheet or online budgeting tool doesn’t fit your personality, there are a few alternative ways to budget, including the envelope system. Remember, there’s no “right” way to manage your money, explore different methods until you find what works best for you.

If you need to reduce spending even more, explore this list of ways to save on must-have expenses.

::Additional Resources::

Budgeting Tools

Calculators

- Personal Budgeting Tool, Oklahoma Money Matters

- Rework Your Budget Calculator, Practical Money Skills

Websites